Happy New Year everyone! I hope each of you are safe and sound and ready to take on 2021.

Looking back at 2020, it is totally bizarre that it would take a pandemic to boost the real estate market. After two years of declining values, BC Assessment records show increases of 0% to 10% for properties in BC.

And note BC Assessment is a snapshot of value based on July 1 of last year, so the current value is probably a bit higher now.

As a whole the year’s real estate numbers are middle of the road. The total sales number was 2.8% below the 10-year average and the total listings were 2.7% below the 10-year average. Considering two years of declining values and weaker sales, a middle of the road year is a good year. And for a pandemic year, fantastic! The year ended with the benchmark price for detached homes up 10.2%, for townhomes up 4.9% and for apartments an increase of 2.6%.

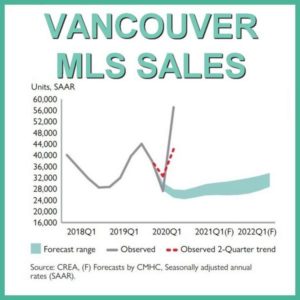

Because of the halt to the market when Covid-19 started, it seems the sales were just pushed back to the end of the year. As a result, the sales number this December was the highest ever! It was 57.7% above the 10-year December average.

The sales-to-active listings ratio is a measure of the demand for real estate. When it is above 20% the demand is so great that there is an upward pressure on price if this is maintained. And when it is under 12%, there is downward pressure on the price. For detached homes it is 35.2% for December and the benchmark price went up 1%. For apartments, it is 33.1% and the benchmark price was unchanged for December. For attached homes, the ratio is 50.4% which is extremely high but the benchmark price was actually down 0.1% from November. With such strong numbers, it maybe be true that the market will continue to be strong in 2021.

However, predictions are all over the place. And with covid-19, the new variants and the vaccine rollout, it is harder than ever to predict. Re/Max predicts a 4 to 5% increase in Vancouver home prices in 2021. Royal LePage predicts Greater Vancouver median price of a detached home will increase by 9% in 2021. Central 1 Credit Union predicts a 5.6% rise in media home prices in 2021. BC Real Estate Association is predicting a 1.3% increase in prices in Vancouver.

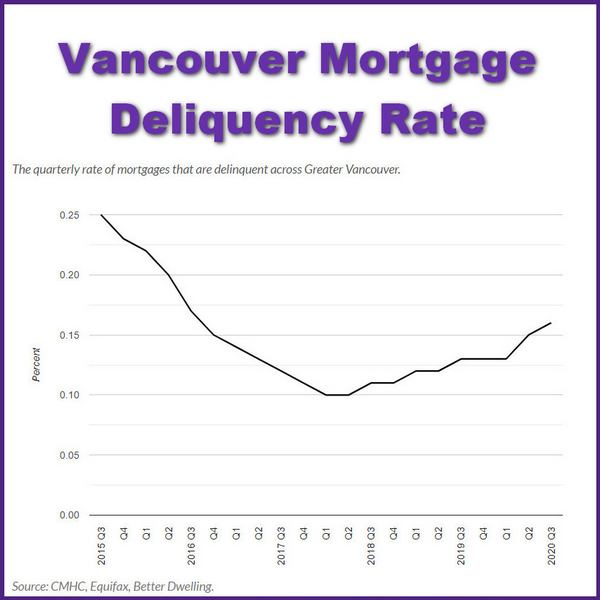

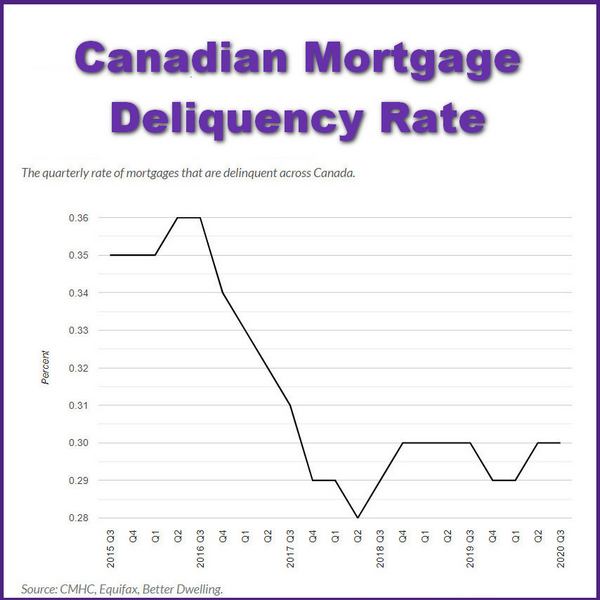

Veritas Investment Research believes an increase in mortgage defaults and investors selling their rental units will cause the price to drop. Depending on the number of defaults, they are expecting a drop of 10% to 17% in Vancouver prices. CMHC has not changed their forecast from May which calls for a drop of 9% to 18% to Canadian house prices. That also came with a prediction of a high mortgage default rate of about 0.6% by now. However, the current rate is closer to 0.3%. I wouldn’t worry about it until that default rate moves up significantly.

RBC’s prediction for Canadian home prices is probably a good indication of how difficult it is to make a prediction. Their base case calls for an 8% drop in prices over the next year. However, they have a best-case scenario where there is a 6.1% increase in price, but the worse case scenario is a 29.6% drop. I am going to stick my neck out and say it is somewhere in-between:)