The market is still active in July but has been declining for several months now. Nevertheless, July’s sales were still 13.3% above the 10-year July average.

New listings are particularly low. 12.3% below the 10-year average and 25.2% lower than the month before. Maybe as the covid restrictions loosen and the summer is upon us, people are putting their housing plans on hold.

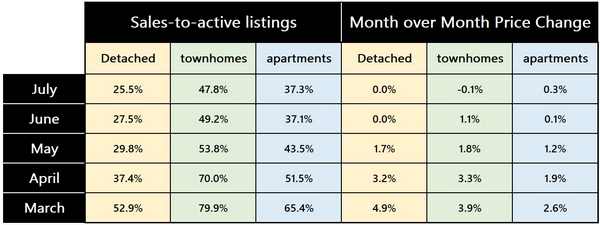

The sales-to-active listings ratio remains elevated but pricing increase has slowed and for townhomes it has actually reversed. While typically ratios above 20% indicate an upward pricing pressure, pricing increase has stalled. The sales-to-active listings ratio for detached homes is 25.5% but there is no increase in the benchmark price over last month. However, it is an amazing 21% higher than last July. The ratio for townhomes was 47.8% but the benchmark price actually decreased 0.1%. However, it has a respectable 16.7% increase from last July. The ratio for apartments was 37.3% and there was a 0.3% increase in the benchmark price compared to June. Over the last 12 month, there was an 8.4% gain in the benchmark price.

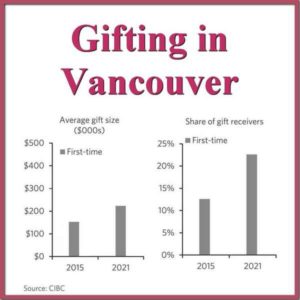

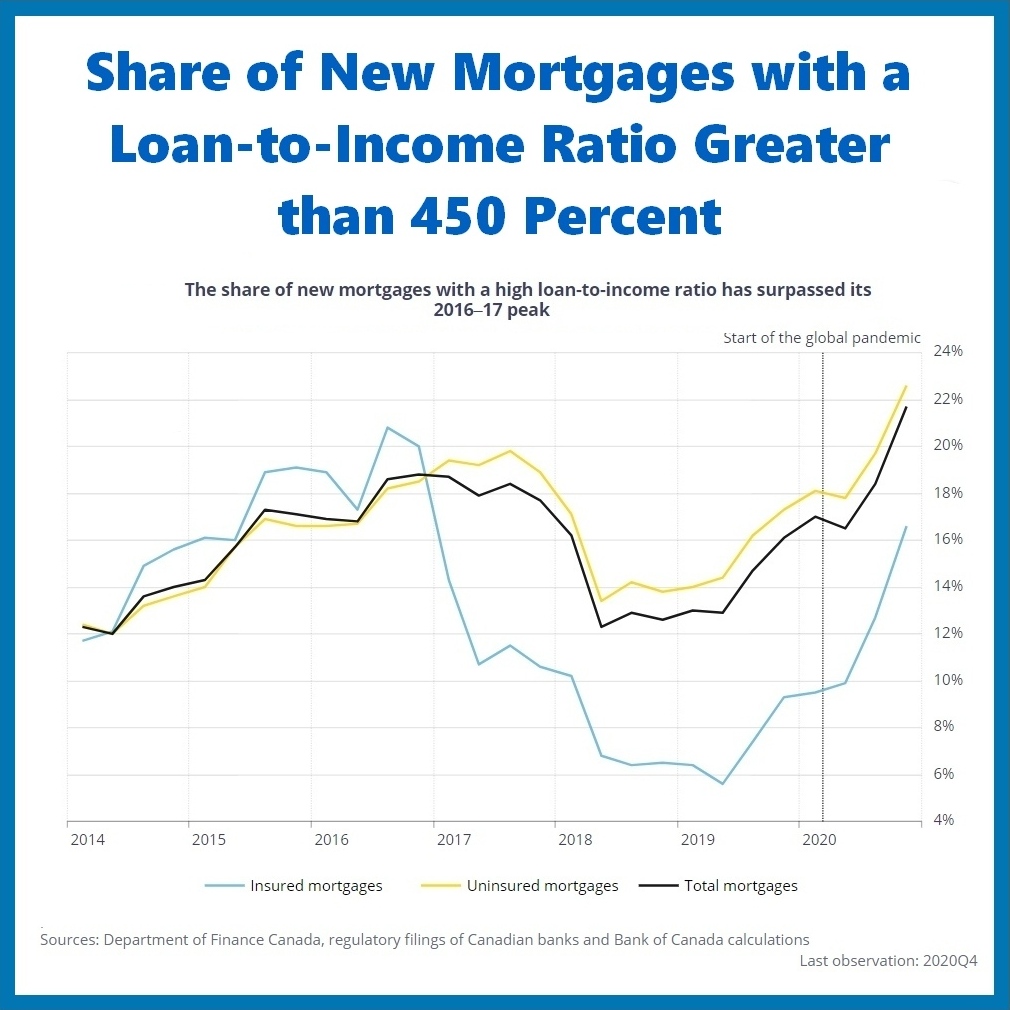

Another reason why the market is slowing down might be that we are running out of buyers. Since mid 2020, there has been an incredible amount of activity. Maybe for most people who wanted to buy, they have bought. This is corroborated by the fact that the quality of the mortgage during the pandemic has been deteriorating. This is measured by following what portion of the new mortgages have a high loan-to-income (LTI) ratio, specifically above 450. As you can see from the Bank of Canada chart, we have surpassed the 2016-17 peak. People are obviously stretching their budget to make home purchase a reality, but how much further can it go. Nobody is getting a 20% raise and your budget can just stretch so far.

The next stimulus that may boost the real estate market may be the eventual return of international travel. Immigration will start back up and bring in a new group of people. When this will happen is still a bit of a mystery as it is very hard to predict the course of this pandemic.

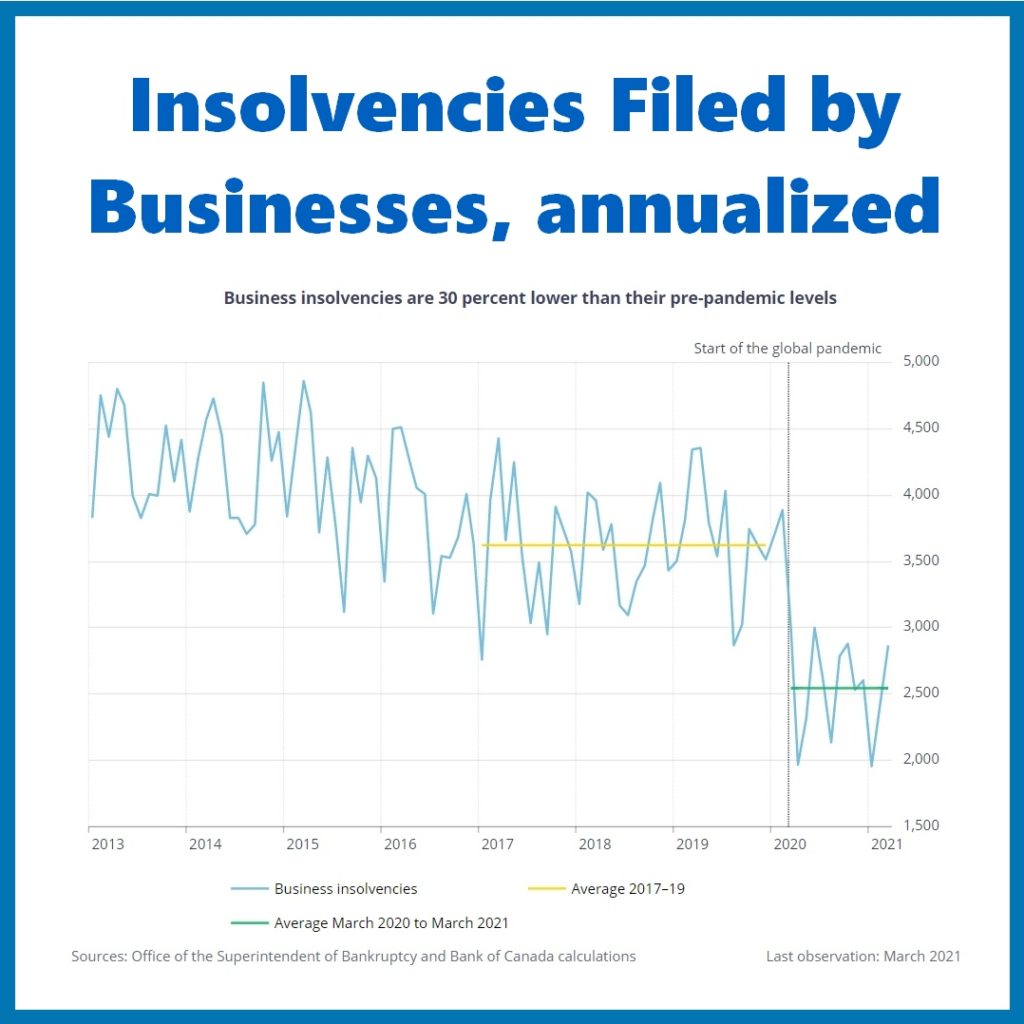

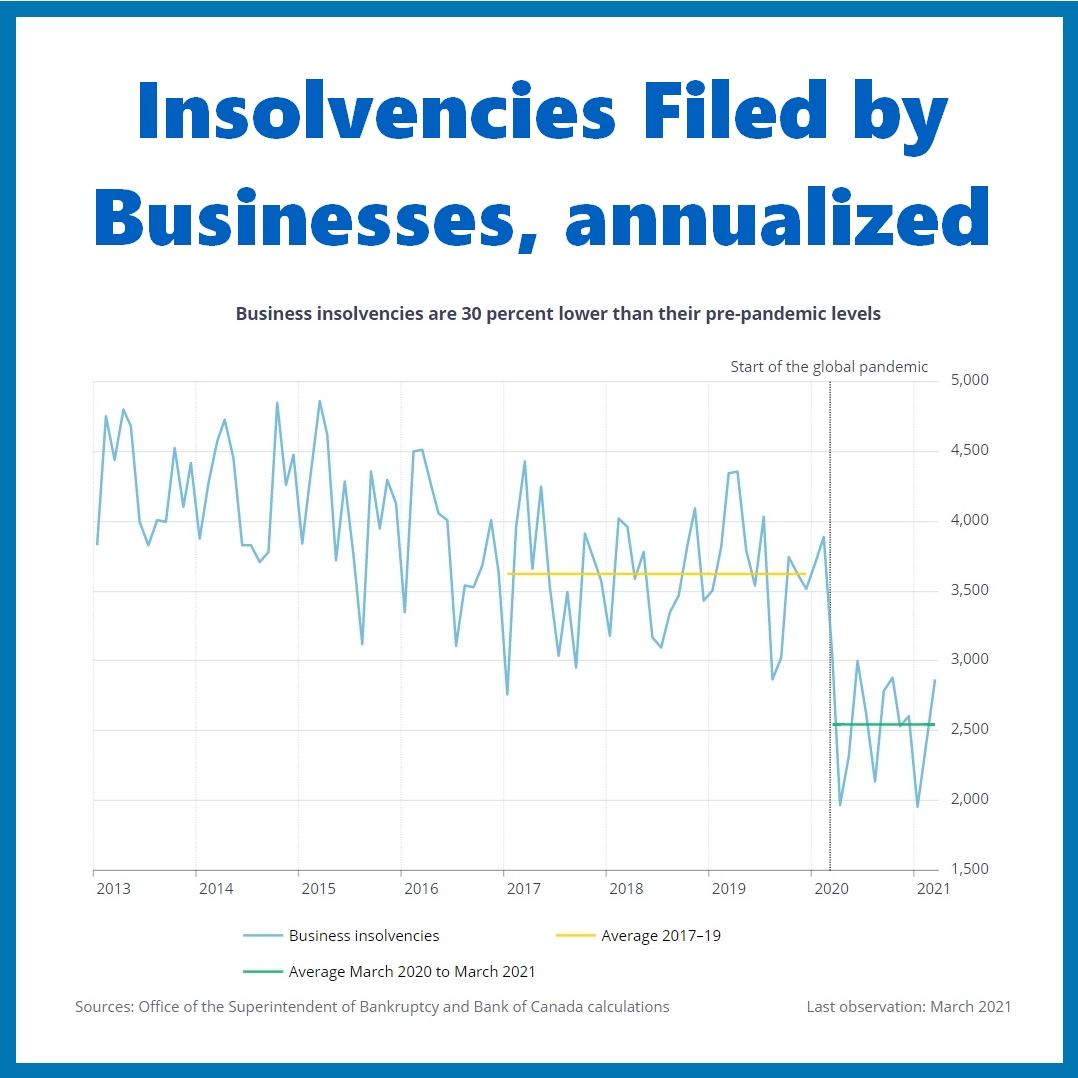

Business failures are also hard to predict. While we hear about the impossible conditions for businesses, business insolvencies are actually 30% lower than pre-pandemic levels. The government has given so much support to businesses, it has distorted the economy. Did the stimulus just delay the bankruptcies? This adds to the unpredictability of the economy going forward. Maybe this is one reason why the central banks are saying that this current wave of inflation is transitory.