The short answer is not really. There is almost no difference. Most people get this mixed up with accelerated bi-weekly where you are paying “extra” on top of the normal amortization schedule. All methodologies in paying off a mortgage faster, actually, are just paying “extra”. And this includes all the fancy “tricks” on YouTube. Accelerated bi-weekly arrive at their bi-weekly payments by dividing the monthly payments by 2. Because there are 26 bi-weekly payments, you are actually making an extra month worth of payments which would go directly against your principal. That is why the mortgage gets paid off faster. That’s it! If you want to see the numbers, continue reading.

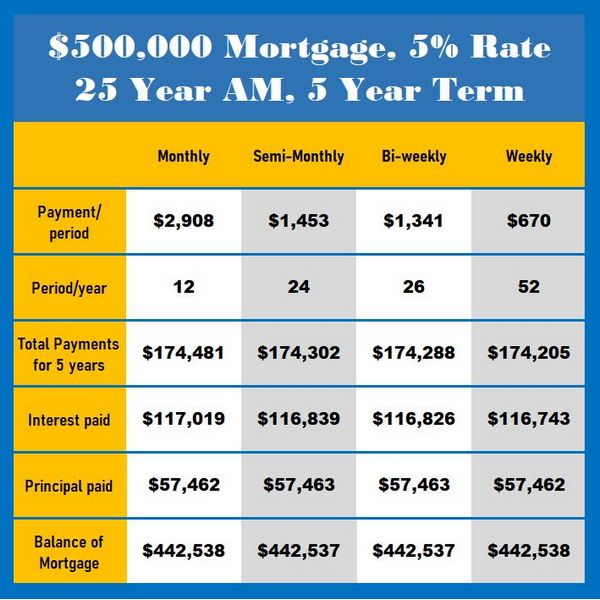

I ran the numbers for a $500,000 mortgage at 5% for 5 years at 25 years amortization. The numbers for monthly, semi-monthly, bi-weekly and weekly payments are in the table above. First note the bottom line, the balance of the mortgage at the end of 5 years. They are basically the same considering rounding errors; thus, the principal paid is the same. So the only difference is the amount of interest paid. If you subtract the interest paid for the monthly payments by the weekly payments, you see the difference in interest paid is $276. By paying weekly, you save $276 over 5 years. On a weekly basis, you are saving $1.06 per payment. You are not paying off your mortgage early with this strategy.

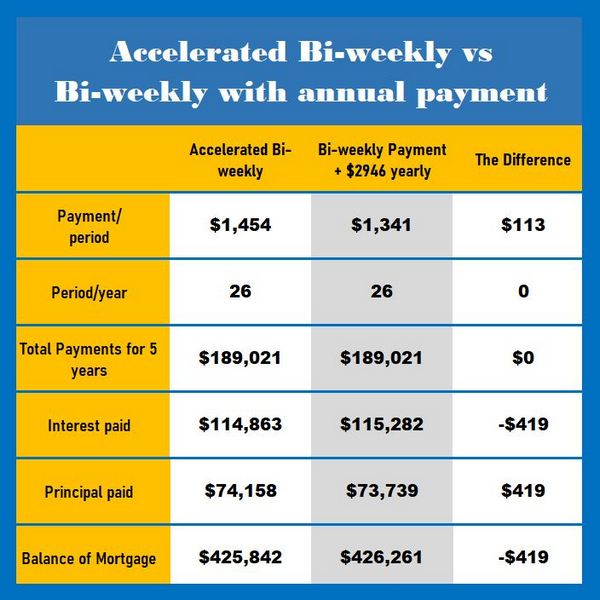

So let’s take a look at the accelerated bi-weekly payments vs regular bi-weekly payments. The table above compares the two payment schedules and the last column is the first column subtracted by the second column. As you can see, doing the accelerated bi-weekly payments you are paying an extra $113 each time. That amount goes against the principal and pays off the mortgage faster. In this case, after 5 years $14,733 was the extra payments and this reduced interest payments by $1,962. This is why the mortgage balance is lower by $16,695. This doesn’t sound that amazing either considering it seems like you are only saving $1,962 in interest but if you continue to do this for decades, the savings are compounded. You will end up paying your mortgage off in 21.5 years instead of 25 years. An interest savings of $59,613.

I often recommend instead of paying that extra $113 per payment, to save it all for one lump sum. Usually, I recommend the lump sum payment after New Years when all your seasonal cash needs are taken care of. This gives you more flexibility around spending during the holiday season. Of course, this is a personal choice that depends a lot on your understanding of your own psychology with money and your regular cash flow around that time of year. But let’s see what this flexibility will cost you. 26 payments of $113 is $2946. So in the second column, we have bi-weekly payments with an annual $2946 lump sum payment at the end of the year. At the end of 5 years, the accelerated bi-weekly payment pays off an extra $419. What is your preference?