There are two main reasons why someone would want to buy real estate inside a corporation. One is for personal liability protection and the other is to make more money.

A corporation is a separate legal entity from the owner(s). This means if something occurs within the corporation that generates a liability, the damage is contained in the corporation.

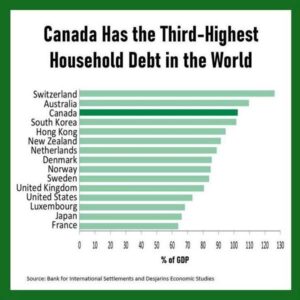

For example, if someone sustains a serious injury at one of your rental properties due to your potential negligence, you may be held liable for damages. If you hold all your properties in your personal name, then everything is up for grabs. This includes all your real estate, your stock portfolio and even future earnings. If that property was held inside a corporation, then only the assets inside that corporation is vulnerable. There is insurance you can buy to mitigate a lot of the risks. So you need to weigh the cost of each option and decide for yourself.

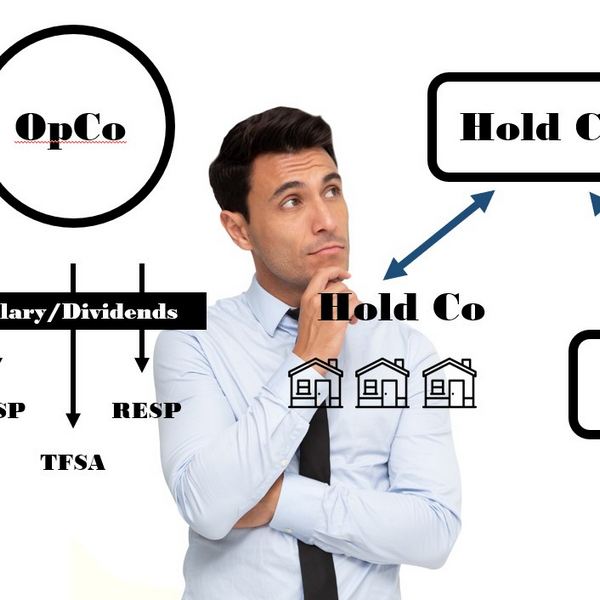

In regards to making more money, it is a much more complicated conversation. In general, if you are buying a few residential properties and you don’t have a corporation that is generating income, it is not worth the extra cost and work associated with creating and managing a corporation. However, if you are planning on buying more than 5 or 6 residential properties then a corporation might make sense because it is often difficult to buy more than 4 properties with personal credit. A corporate structure will also help when you plan to pass your portfolio to your kids. It will allows you to transfer the ownership of the properties by just transferring the shares and allows you to use strategies such as asset freeze for estate planning.

If you already have a successful business that is generating more income than you need for your personal expenses, it makes sense to leave the money inside the corporation and buy real estate with it. Inside the corporation, the first $500,000 of income is taxed at 11%. To take this money outside of the corporation, you can be taxed at up to 53.5%.

And finally, if your strategy is to do flips, then a corporation also makes sense. Money you make from flips are considered 100% taxable as income. Not capital gains. So you will save a lot of taxes flipping inside a corporation. Once again, the income is taxed at 11% inside the corporation. It is only when you pull the money out for personal use that it is taxed at a personal rate. So the idea is to take out only the money necessary for personal expenses and leave the rest inside the corporation.

Before you make a decision to do this consult your team of professionals, mortgage broker, accountant and lawyer, to make sure this makes sense for your specific situation.