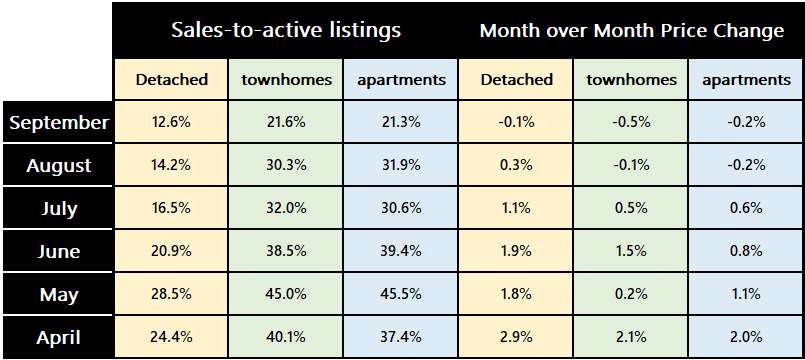

The real estate market in Metro Vancouver has cooled drastically in September. Along with a substantial increase in new listings, prices dropped for all categories. The sales number for September was 26.3% below the 10-year average while the number of new listings was 5.2% above the 10-year average. Obviously, some sellers have waited long enough and needed to enter the market. With this combination, one would expect prices to drop and that is exactly what happened. As you can see from the table below the sales-to-active listings ratios dropped along with the month over month price.

I believe this trend will continue. The yields on long-term Canadian and US government bonds have been going up all month and hit 16-year highs on Tuesday. This will translate to higher fixed rate mortgages, making it more difficult to qualify for a mortgage. Because bond traders try to predict the future direction of rates, bond yields are a lot more volatile than the central banks’ overnight rate which directly affects the variable rate mortgage. Current predictions are that we will have one more 0.25% rate increase this year from the central banks and most likely a drop in rates starting in the 2nd half of 2024.

There is increasing data to support a slowing economy but I think the question is how slow does the economy have to get before Jerome Powell will start to lower rates. And this is the $64,000 question.

Enjoy the rest of the month and have a happy Thanksgiving!