Happy New Year! I hope you had a great holiday season. The property assessments for British Columbia have been issued, and their updated values are now available on the official website. These figures represent the government’s valuation as of July 1st of the previous year.

According to BC Assessment, in the Lower Mainland, the average home values have varied from the previous assessment by -5% to +5%. According to the MLS Home Price Index, the composite price for all residential properties in Metro Vancouver has seen a 5% increase over the past 12 months. This increase is somewhat unexpected given the market’s weakness in the latter part of the year. The sales volume for 2023 was 23.4% lower than the 10-year average. The number of properties listed was 10.5% less than the 10-year average. So with the low demand, there was also low supply. This discrepancy contributed to a price surge earlier in the year when rates were lower that accounts for this 12 month price gain.

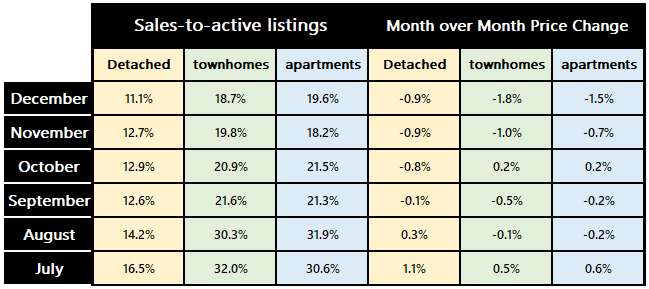

But in December, the sales were even slower than November, dropping to 36.4% below the 10-year average. New listings also remained low, at 22.7% below the 10-year average. However, this did not halt the decline in prices. The sales-to-active listings ratio for all property categories has stayed below 20% and has been on a downward trend for seven consecutive months, indicating a decrease in demand. Consequently, prices have continued to drop month over month.

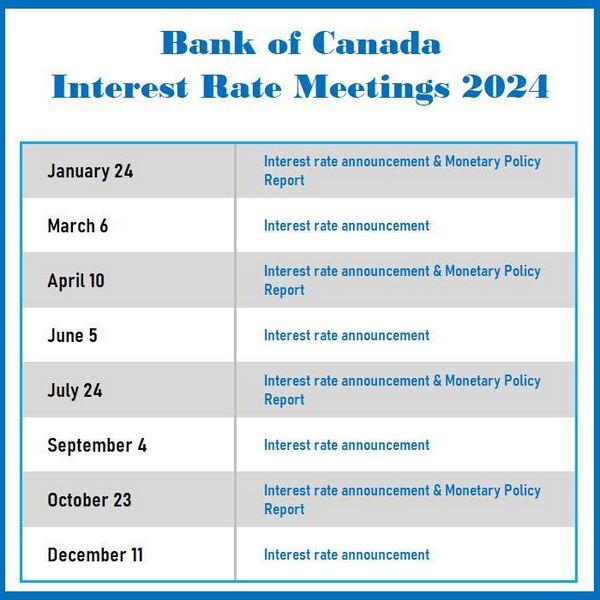

A significant number of experts and forecasters are predicting that central banks will implement rate cuts in 2024, most likely in the second half of the year. If this occurs, it might attract buyers who have been waiting on the sidelines. However, this will largely depend on the inflation data as the year unfolds and the subsequent announcements made. The schedule for central bank announcements in Canada and the US is provided below, ensuring you don’t miss any important updates.

Have a great month!