Did you know that starting August 1, 2024, lenders in Canada will be able to offer 30-year amortizations for insured mortgages to first-time home buyers purchasing a new build? This change is part of a government initiative to help Canadians with less than a 20% down payment buy a home.

Insured mortgages allow buyers to put down less than 20% of the purchase price by paying an insurance premium that covers losses in case of mortgage default.

Will This New Program Impact the Market and Help You Qualify?

This new program is specifically designed for certain buyers and sellers. To qualify, the property’s price must be under one million dollars, which can be limiting in markets like Vancouver. Additionally, pre-sale condo purchases typically require a 15% to 20% down payment, meaning this program is unlikely to impact the pre-sale market. People who already have a 20% down payment won’t need this program.

However, for vacant, move-in-ready condos, this program could be beneficial. Let’s look at an example to understand how it might help:

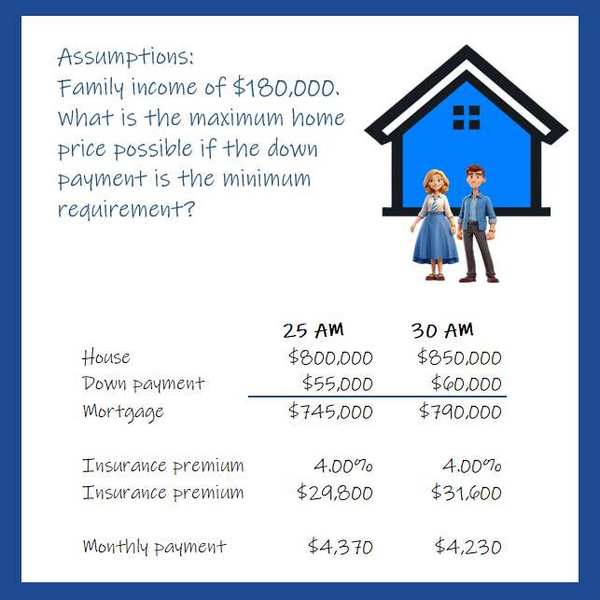

- Condo Price: $800,000

- Without Mortgage Default Insurance: Requires a down payment of $160,000.

- With Insurance: Minimum down payment is $55,000, calculated as 5% of the first $500,000 and 10% of the remaining purchase price.

Financial Breakdown

Assuming the following:

- Property Tax: $2,500 annually

- Condo Fee: $500 per month

- Interest Rate: 4.64%

- Amortization Period: 25 years

- Down Payment: $55,000

You would need a family income of $180,000 to afford this home. The insurance premium is 4%, adding an additional $29,800 to your mortgage. This results in monthly payments of approximately $4,370.

Impact of a 30-Year Amortization

If you apply for a 30-year amortization instead:

- Monthly Payment: Decreases to $3,990

- Alternative Benefit: You could keep the monthly payment around $4,370 and qualify for a property that is about $50,000 more expensive.

Conclusion

Given the narrow target audience and the marginal increase in purchasing power, the overall impact on the market is expected to be small. However, for those who qualify, the 30-year amortization can offer some financial flexibility and make homeownership more accessible.