As articles continue to warn about the impending fall of the real estate market, the market in the Greater Vancouver region just chugged along. While not as strong as September, October sales were 34.7% above the 10-year October average and the second highest October sales figure on record.

The sales-to-active listings ratios point to townhomes as being the hottest segment. This is probably due to the combination of affordable price range and livability. More people are wanting a larger space because they are working from home. The sales-to-active listings ratio for detached homes is 30.9%, for townhomes is 43.5% and for apartments 24.9%. Apartments is the weakest segment but any time the ratio goes over 20%, it is considered to be an indication of upward pricing pressure. When the ratio is below 12%, then it is indicating downward pricing pressure.

The benchmark price for a detached home increased 8.5% year over year and increased 1.1% over last month. For attached home the benchmark price increased 5.4% year over year and increased 0.4% over the last month. The benchmark price for an apartment increased 4.4% year over year but remained unchanged from last month.

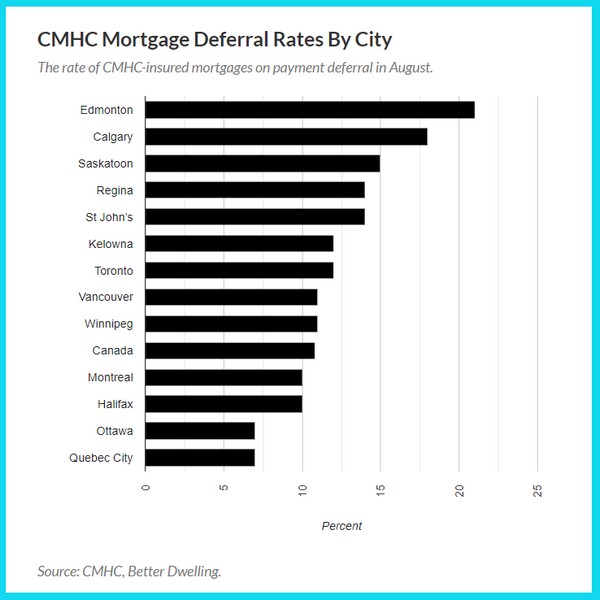

The latest report from RBC Economics came out on October 29, stating how risky the housing market is in Vancouver, but it fails to give new reasons to support the theory. The old reasons such as high unemployment, high mortgage deferral rate, end of mortgage deferral, lower immigration and over supply of condos are reiterated.

In terms of mortgage deferral rate, some believe most people who are on it do not need it. Antidotally, I have come across people who were on mortgage deferral who were looking to buy a rental property. Some analysts believe that 1 in 5 people who deferred their mortgage will default since the mortgage deferral program has ended. However, I think some of them would have sold their property in this rising market, so there will not be a rapid disorderly exit of the real estate market. And whether the real estate market will drop at all, I believe depends on how much the money the government is willing to put into the economy. And how can you predict that?