It is no big surprise that mom and dad have been helping their children get into their first home in the lower mainland. And as the price of property continue to increase, the demand is greater than ever. What is surprising is how hard it is to get good data on this.

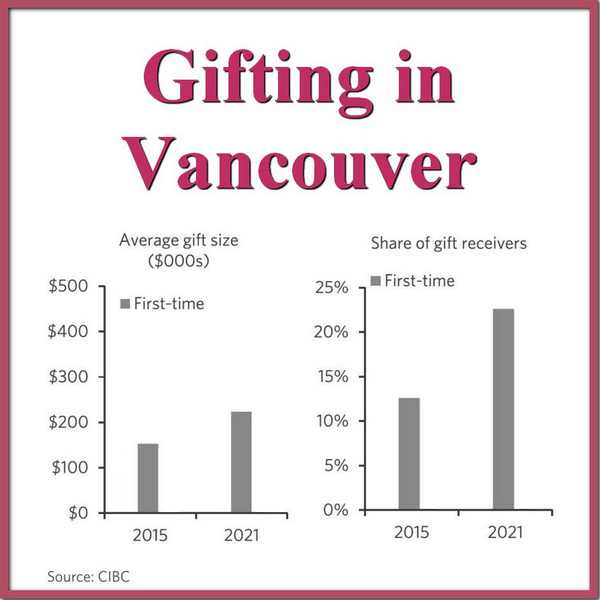

CIBC released a report last month on gifted down payments. It summarized their data from 2015 to 2021. In it they state that in Vancouver, around 12% of the first-time home buyers got help to buy their first home in 2015 and by 2021 this has gone up to around 23%

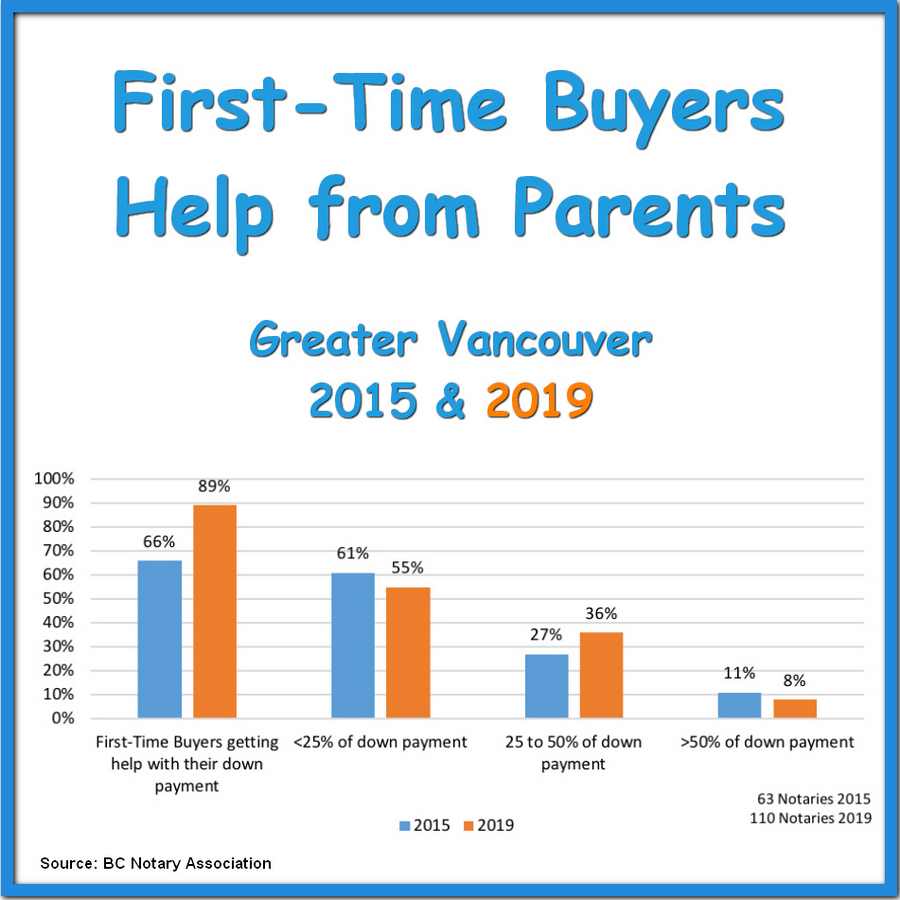

The BC Notary Association did their own survey in 2015 and 2019 to measure the extent of this help and the results are very different. According to them, in 2019 almost 90% of all first-time home buyers are getting some sort of financial help from their parents. And this is up from 66% in 2015.

Of the ones getting assistance, most of them are for less than 25% of the down payment. In 2019, only 8% of the buyers getting parental assistance got more than 50% of the down payment from the parents. Understandable. With the high price of real estate, 50% of the down payment can be a hefty chunk of change. Parents have to retire too.

I really can’t understand why the figures are so different. Who do you believe?