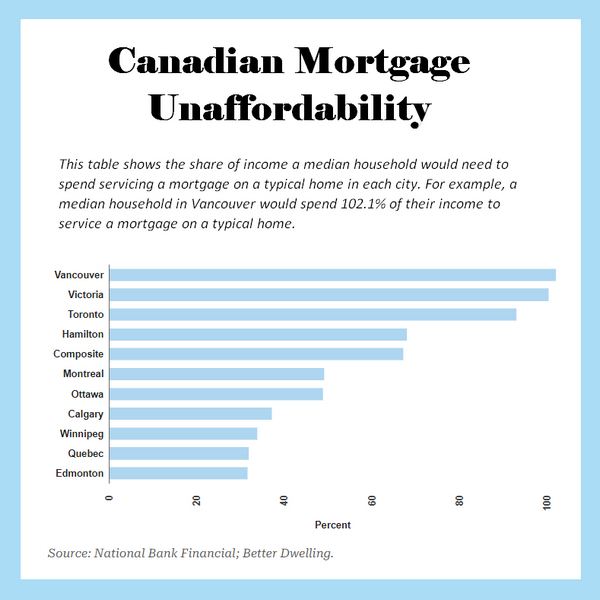

Currently housing affordability in Vancouver is the worst since in 1981 when the mortgage rate peaked at 20%. You know how the government promises affordable housing and whenever a project is finished, it doesn’t seem that affordable. Have you wondered how much a property would cost if we took out the exorbitant builder’s profit and all the fees the government charges? I am going to try to figure this out from some readily available data and see how affordable housing can be.

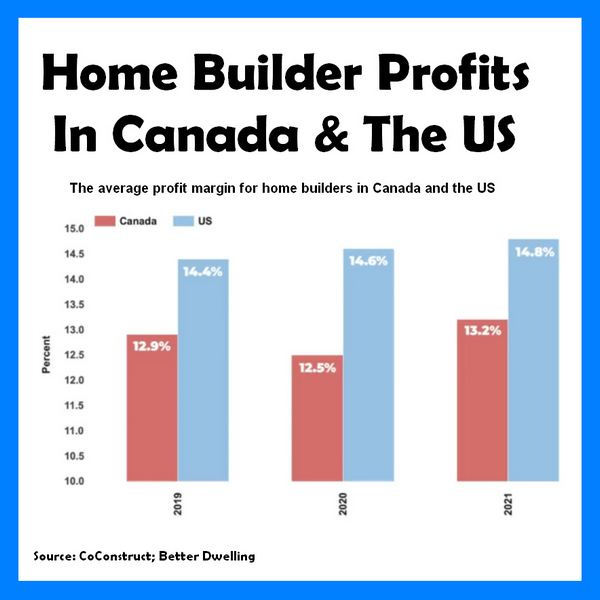

From a study out this year by CoConstruct, a construction management software company, the average profit margin for a builder in Canada is 13.2%. Did you expect it to be higher? I was a bit surprised, especially when you compare it to government fees for condos.

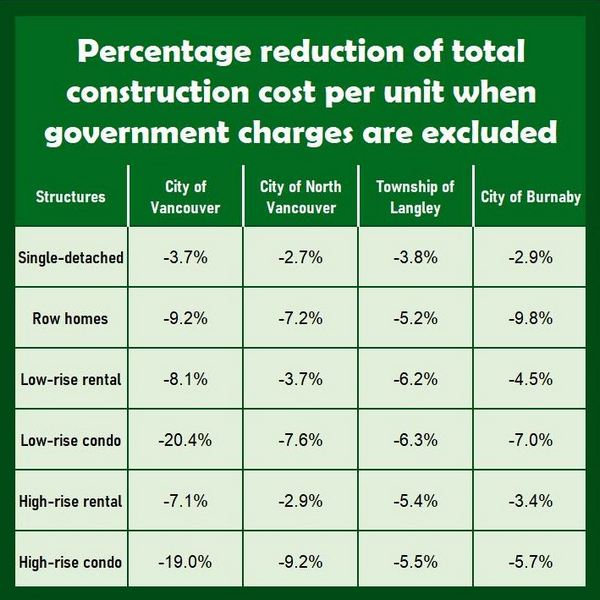

Based on the 2022 July Housing Market Insight by the CMHC, we find that if government charges were excluded from construction cost, there would be a reduction of 3.7% on the construction costs for a detached home and about 19.7% if it were a condo.

According to the November issue of the Real Estate Board of Greater Vancouver, the benchmark price for a detached home is $1,892,100 and the benchmark price for a condo is $727,100.

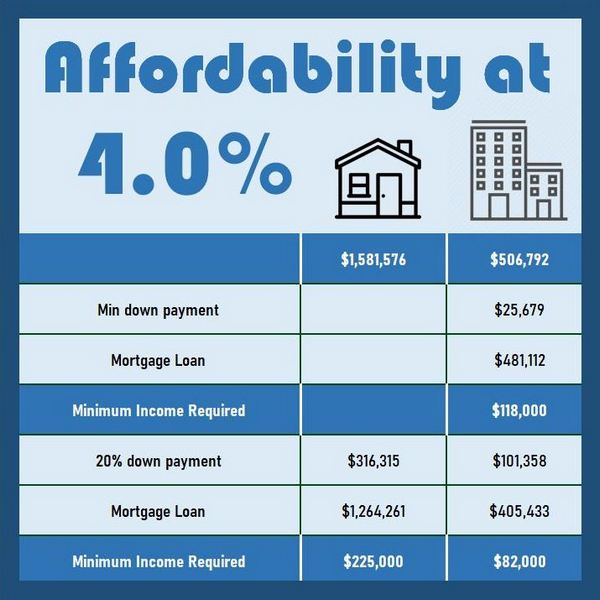

If we took off the 13.2% to account for the profit and then the 3.7% or 19.7% for the government charges, we would be left with the bare bone construction costs for the house and the condo. In this case, it would be $1,581,576 and $506,792 respectively.

Because there is no mortgage default insurance for a property over $1,000,000, the minimum down payment is 20% for the house. For the condo which is below 1M, there is an option to purchase mortgage default insurance which will allow for a smaller down payment. So instead of 20%, the minimum down payment would be 5% for the first $500,000 of the value of the property and 10% for the rest. So that would be $25,679 in this case. 20% would be $101,358. For the house, the 20% down payment equals $316,315. The benefit of the 20% down payment is that we can extend the amortization of the mortgage from 25 years to 30 years which will allow us to borrow slightly more money.

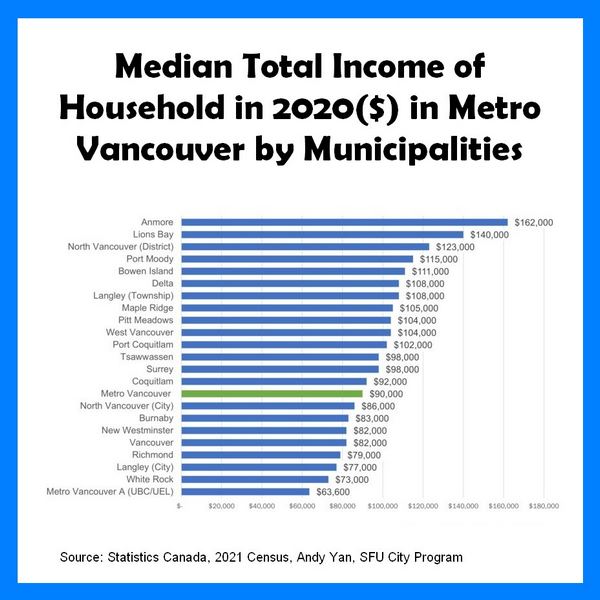

Currently the 5 year fixed rate is around 5%. Using this rate, the annual income needed to buy a house would be $245,000. The annual income needed to buy the condo would be $89,000 if there is 20% down payment, or $126,000 if we put down the minimum down payment. According to the 2021 Census, the median family income of someone in metro Vancouver is $90,000.

This picture improves slightly when the 5 year fixed rate drops to 4% which is possible later in the year or early next year if the current forecasts are correct. But you are still looking at an annual income of $225,000 for the house and $82,000 to $118,000 for the condo.

Do you think affordable housing is achievable?