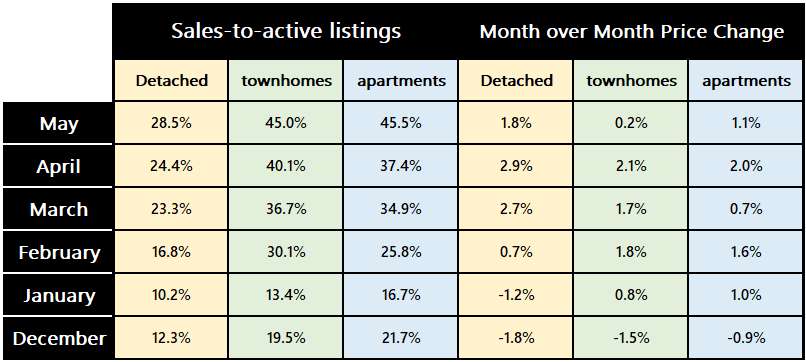

In Metro Vancouver, the real estate sales are picking up, but the inventory remains low, so prices continue to climb. The sales volume in May are back to normal. It is only 1.4% lower than the 10-year May average while inventory is 20.6% below the 10-year May average. As you can see from the table below, the very high sales-to-active listings ratios are indicative of the high demand relative to supply. And as a result, you see the month-over-month price increase in all categories.

Anytime the sales-to-active listings ratio is above 20%, it is indicating upward pressure on prices. At over 40, it is evidence that the fear of missing out (FOMO) is back again. This is why there are multiple offers and listings selling above list price. Article headline like “One in four Canadians plans to buy investment property in next five years “ does not help. That means if you were at a poker table, one person there will be buying a property within 5 years. I looked at the report but cannot figure out how they came up with this number. Seems too high but as long as the government continues to support real estate prices with their policies, a strong demand for real estate is not a surprise.

What the last several decades have taught us is that no matter how disconnected the housing prices are to local incomes, there is little downside and all upside to owning property. Prices are already at unreasonable levels. There is not enough housing being built for people already here. The government then decides on an aggressive immigration policy without planning for additional infrastructure. The extra demand created by the 500,000 new immigrants per year will create support for real estate prices. But where are people going to live? Rent for a one-bedroom suite in Vancouver is $2787 a month. Look forward to more vans and campers parked overnight in your neighbourhood.

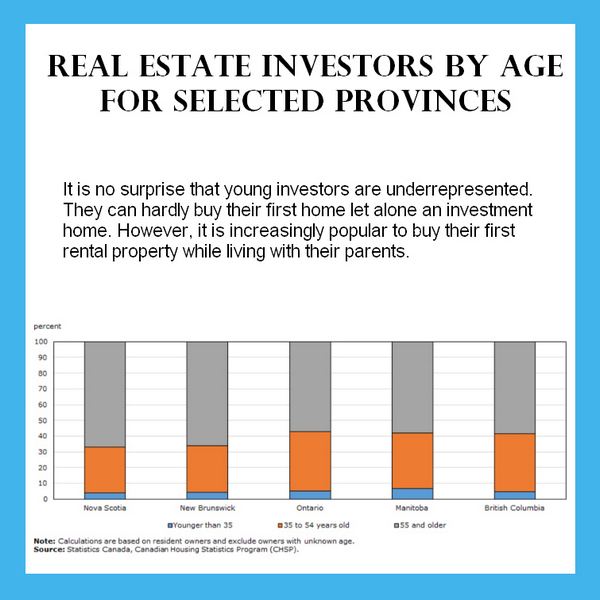

This is also why you hear that there might be more investors than first time home buyers soon. And that the investors are mainly over 55. Well, people over 55 probably bought their first home 20 years ago when it was affordable. The property is now probably worth millions. And believing real estate doesn’t go down in Canada, they are taking out the equity to purchase an investment property. Why would people invest in a small business or anything else when a 2M property is making them $140,000 a year (7% return). And if they only put down 20%, this is a cash-on-cash return of 35%. This is not the basis of a healthy economy or society.

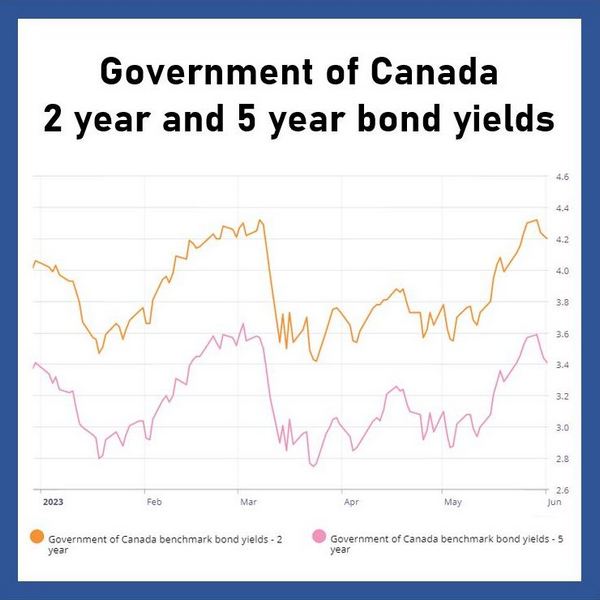

Some say the lower mortgage rates was part of the reason for the pick up in activities. If this is true, then there might be headwinds going into the summer because the Bank of Canada bond yields have been climbing in May and the corresponding mortgage rates have also climbed in response. But only fixed rates as bond yields do not affect the variable rate mortgages.

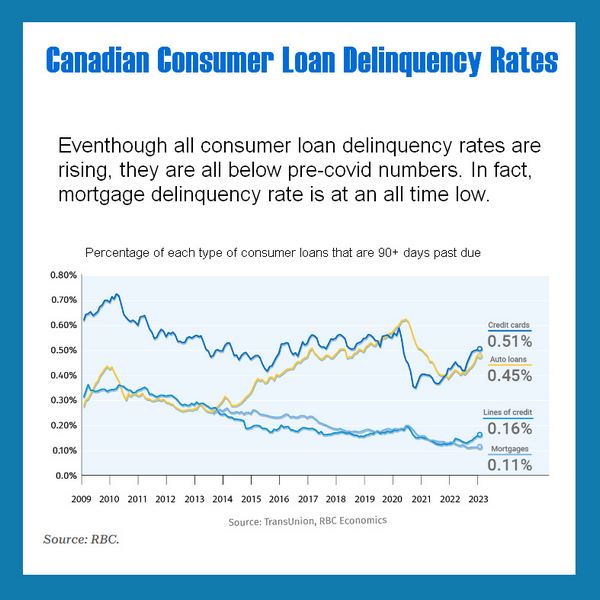

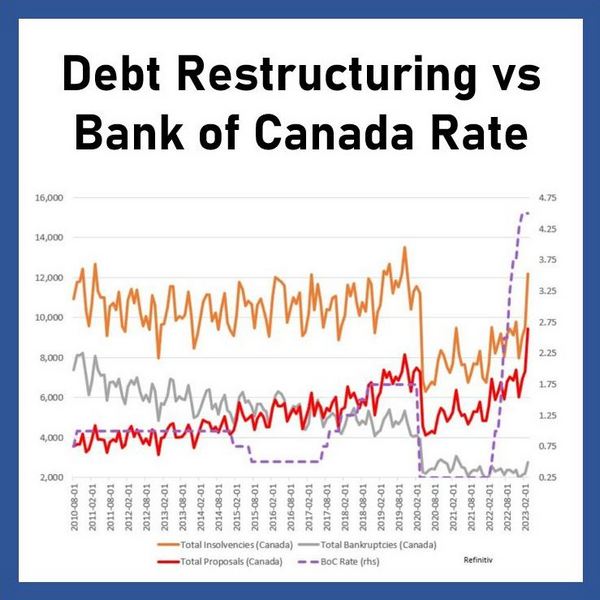

But don’t expect any extreme price drops. The ability of the banks to increase amortization to infinity is helping to prevent defaults. Yes, the delinquency rate is going up but from a historical perspective, it is nothing to worry about. From the chart you can see the delinquency rate of credit cards, lines of credit and auto loans are picking up but they are still below pre-pandemic levels. Also mortgage delinquencies are at a record low. This is why you see bankruptcies at multi-decade lows while consumer proposals and insolvencies are picking up. They are not a concern yet, but definitely worth keeping an eye on.

Have a great month and remember it is Father’s Day on the 18th. Show them some love.