How would you like a 20% no risk return? Usually if you hear this offer, turn around and run! It is a scam. However, if you typically have an outstanding credit card balance, then this is possible. Just by paying down your credit card debt, in essence you are making a 20% return. And 20% is a lot!

If you invested $1000 with a 20% return, you would get an extra $200 the first year. The resulting $1,200 would provide you with another $240 in year 2. In 10 years, the compound growth would give you a total of $5159.78. That is 5X the original amount! But what if instead you bought a $1000 LV bag or a vacation with your credit card? If you didn’t make any payments, you would owe $5159.78 in 10 years! But what if you made minimum payments?

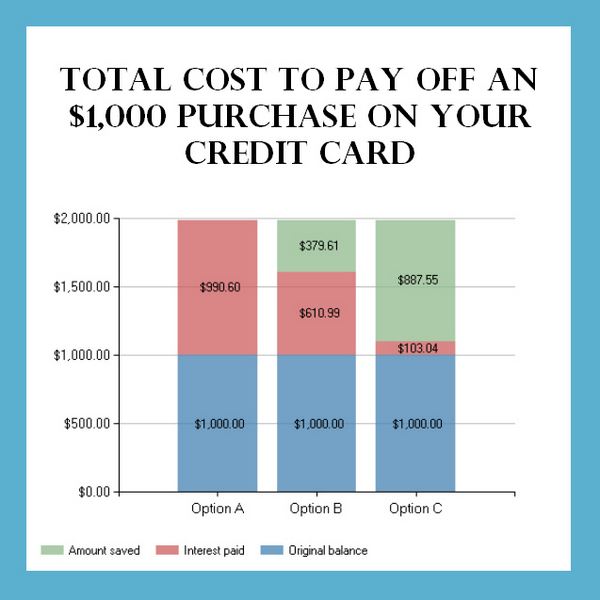

The Canadian government provides a handy calculator to figure all this out (click the graphic below to access). In the situation (Option A) where only minimum payments are made, it would take 10 years and 11 months to pay it off. At the end the total amount paid would be $1990.60. Almost doubling the original cost. By paying an extra $5 a month (Option B), it would reduce the time to pay it off to 6 year and 6 months and bring the total amount paid down to $1610.99. This highlights the power of compounding on debt. The $5 a month saved you 4 years and 5 months and $379.61. If you were disciplined enough to pay $100 per month, this would be paid off in a year and the total amount paid would be $1103.04.

So the first step to personal financial success is to pay off your debt first. And of course do not incur it in the first place unless absolutely necessary. So don’t buy something unless you have the money for it.

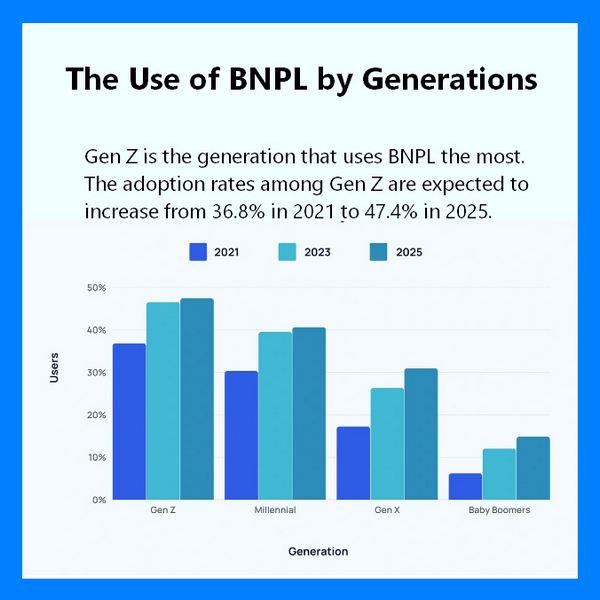

Anytime you are borrowing to spend, you are paying for this privilege and reducing the amount of money you can spend on yourself later. And this is why the growth of the BNPL (Buy Now Pay Later) services are a bit disturbing. It is expected that almost half of Gen Z will be using BNPL by 2025. This trend is not your friend. Resist the temptation.