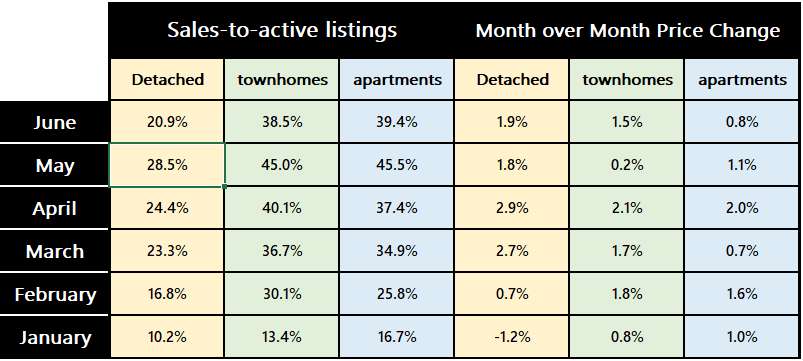

The sales volume in June for Metro Vancouver’s housing market is relatively strong considering the high interest rate environment but it does show weakness. The sales volume was 8.6% below the 10-year June average but last month’s sale volume was only 1.4% below the 10-year May average. Tight supply continues to provide upward pressure to home prices. The table below shows increases in all segments of housing during the month of June. The sales-to-active listings ratio tapered a little indicating a slight slowing in demand. This may be an indication of things to come.

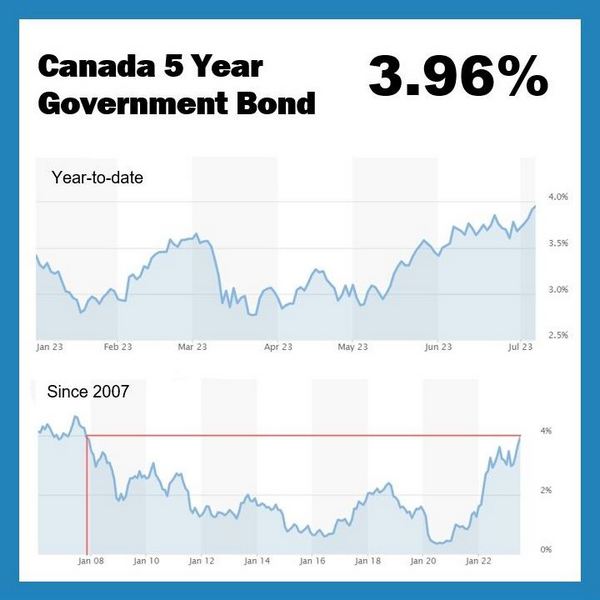

The Bank of Canada’s June 7th rate hike and the possibility of future rate hikes has caused the bond market to react by driving the yield up on the bonds which are directly tied to fixed mortgage rates. The Government of Canada 5 year bond is currently yielding 3.96% which is the highest it has been since December 2007! RBC thinks the price momentum will slow while Oxford Economics believe that the price correction that started last year will resurface. With the fixed rate jumping about 1% over the last 6 weeks, a slow down is not surprising. The effect will be gradual because buyers can hold rates for up to 120 days.

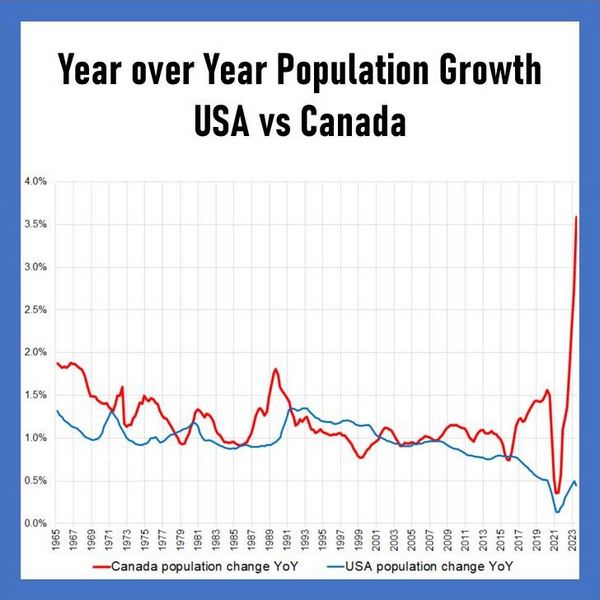

The strong job data released today suggests that the Bank of Canada will likely raise interest rates next week. Many experts believe this may be the final rate hike for Canada, while the United States is expected to have two more hikes. However, it’s important to note that this outlook could change if new data indicates a different direction. Predicting rate cuts is challenging because our economies, particularly the US economy, are not behaving in the expected manner. Most economists projected a recession by now, and many key economic indicators point towards a recession, except for employment. The strong employment figures indicate that people are still spending, leading to increased prices. As long as this trend continues, central banks may opt to raise rates further. The best explanation I’ve heard to explain this situation is that the lag between rate hikes and their impact on the economy can vary a lot. Also the savings resulting from Covid stimulus measures have delayed our progression into a recession. If this theory holds true, we can anticipate the onset of a recession in approximately six months. Once we enter a recession, it will likely indicate that rate cuts are on the horizon.