Welcome to the review of Metro Vancouver’s real estate market for July. I hope everyone in BC enjoyed their BC Day long weekend. Real estate sales continue to be weak in an environment of increasing inventory. However, the sales numbers actually improved over last month on a 10-year seasonal basis. While June was 23.6% below the 10-year seasonal average, July was only 17.6% below. Despite this improvement, inventory is building faster than sales. As a result, the total number of properties listed for sale increased from 20.3% above the 10-year seasonal average to 21.5% above. Inventory is now 39.1% higher than in July of last year.

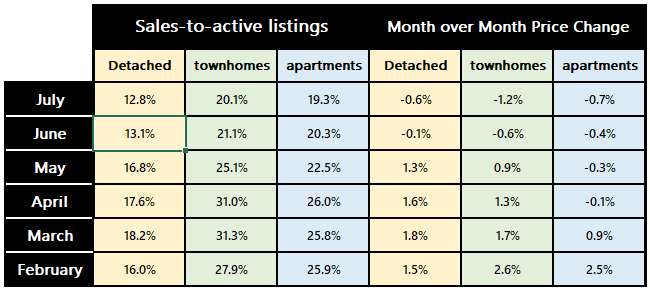

This increase in inventory has led to a drop in both the sales-to-active listings ratio and the benchmark price in all categories on a month-over-month basis. The sales-to-active listings ratio is a measure of supply and demand, with lower numbers indicating a weaker market and an increased likelihood of price decreases. A weakening trend in the sales-to-active listings ratio began four months ago, and the impact is now visible in the price drops.

Recent weak US employment data has accelerated predictions of rate cuts. In mid-July, a Bloomberg survey of economists expected the Bank of Canada’s overnight rate to decrease from the current 4.5% to 3% by the end of 2025. Now, that timeline has been pushed up by six months. If the survey is correct, the Bank of Canada will drop the rate by 0.25% in each of the next four meetings, resulting in a 1% decrease by January 2025, reaching 3% by mid-2025.

This is great news for people with variable-rate mortgages, especially those with variable payments. Whether this will revitalize the real estate market is less certain.

Possibly, but a weak economy, higher unemployment, and rules against flipping, foreign ownership, and short-term rentals will continue to pose challenges.

Have a great the month.