Though sales activity in Metro Vancouver has slowed in January compared to December, the volume is still 25.3% above the 10-year average. Inventory continues to be extremely low which is why prices continue to increase.

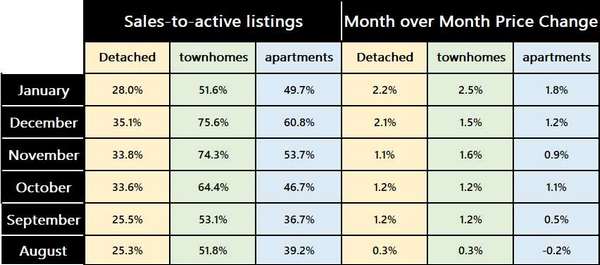

The total number of listed homes is 31.8% lower than last January and an 8.2% increase compared to December 2021. Though the sales-to-active listings ratio has dropped in January, prices continue to go up. Typically ratios above 20% over several months will have an upward pressure on price. For detached homes, the ratio is 28% and the monthly price increase is 2.2%. Annually it is up 22.7%. For apartments the ratio is 49.7% and the monthly price increase is 1.8%. Up 14% from January 2021. For attached homes, the ratio is 51.6% and the monthly price increase is 2.5%. For the last 12 months, it is up 24.3%.

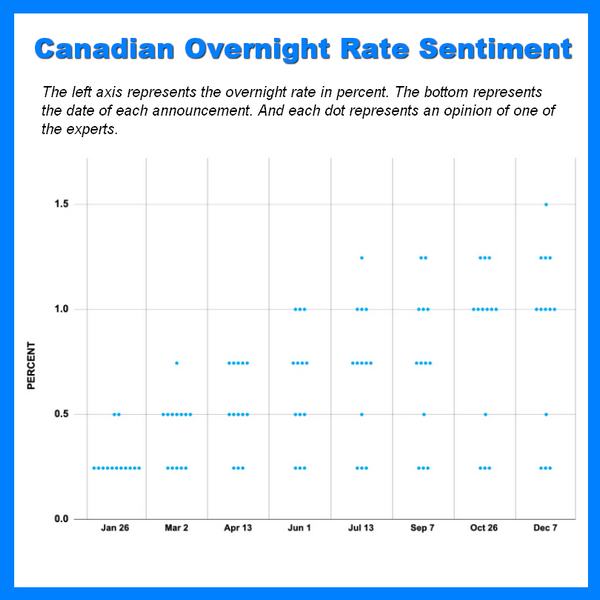

Most predict a slow down in sales activity this year. Reasonable considering how hot it was last year. With such low inventory, no one predicts a price drop this year. There are a lot of new construction in the pipeline and some expect this increase in supply will moderate price increases in the coming two years. But the most important factor at play that will affect the real estate sales activities and pricing is how much and how fast the Bank of Canada will raise their overnight rate. It is a fine balance between raising it enough to curb inflation and crashing the economy. Currently the overnight rate is at 0.25%. Typically the banks’ variable rate goes up in lock step with this rate. Canada’s big 5 banks have forecast for this rate to be between 1% and 2% by the end of the year. To see the uncertainty going forward, look at the dot plot provided by the website Better Dwelling. They approached the country’s most prominent economics and finance experts and had them forecast the overnight rate at the end of each Bank of Canada meeting. You can see all the names here. Each dot represents a prediction. As you can see the further out in time you go, the more dispersed the predictions. This was done before the meeting on January 26. We now know that they didn’t raise the rate at that time.

I am surprised that 3 of the 13 do not believe the Bank of Canada will raise rate at all this year. Just goes to show how hard it is to predict the future. This is going to be another interesting year.