With at least one more rate increase by the Bank of Canada overhanging the real estate market in Metro Vancouver, sales continue to be slow in November. It is 36.9% below the 10-year November sales average. The inventory is building up as a result. It is 28.5% higher than November of last year. It seems sellers are not interested in selling into a weak market during an annually slow period as the number of newly listed properties dropped 24.2% from October 2022 which is also 22.9% less than November of last year. However, this has not stopped the price from deteriorating faster. The sales-to-active listings ratio is a measure of supply and demand in the market and does give an indication of the pricing trend. Generally when the ratio is between 12% and 20%, it is considered a balanced market, but it is the trend that indicates the pricing direction. The trend has been down for the last 9 months and the prices have been dropping for the last 7. The benchmark price for detached properties has dropped 1.9% compared to last month leading to the loss of all of its gains in the last year. In fact, it is down 1.7% from November 2021. The apartment home prices are holding out a bit better with a 0.9% decrease from last month and hanging on to a 3.5% gain from last November. Attached home prices dropped 1.5% in the last month but still have a 2.7% gain from a year ago.

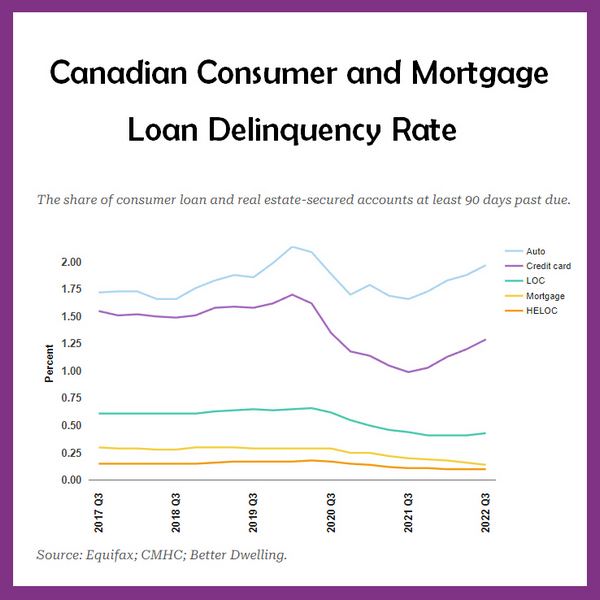

The Bank of Canada will announce the next rate increase December 7th and the Federal Reserve will announce theirs on December 14th. Many believe that Canada will raise the overnight rate one more time before a pause. Somewhere between 0.25% and 0.50%. For the Federal Reserve, many believe they will raise their rate by 0.50% in December and possibly one more time in early 2023 before pausing. This makes sense as there are indications of a slowing economy in the US and Canada and the full effects of the rate increases will take 12 to 18 months to work through. They can easily overshoot and some think they already have. Car loans and credit card debt are showing an increase in delinquencies but are still considered low. Also mortgage delinquencies are actually decreasing. Overall we are in better shape than the US. As the economic data comes out in 2023, the central banks will decide whether they have overshot drastically. If they have, they will pull rates back drastically as well, but most think it will take 6 to 9 months before the real picture will emerge. Of course, unless something breaks. For example, like in the UK where the government bond market suddenly collapses.

Well, the year is coming to an end soon. I would like to thank everyone who has been reading my newsletter and everyone for their referrals. I wish everyone good health and prosperity. Enjoy the holiday season with your loved ones.