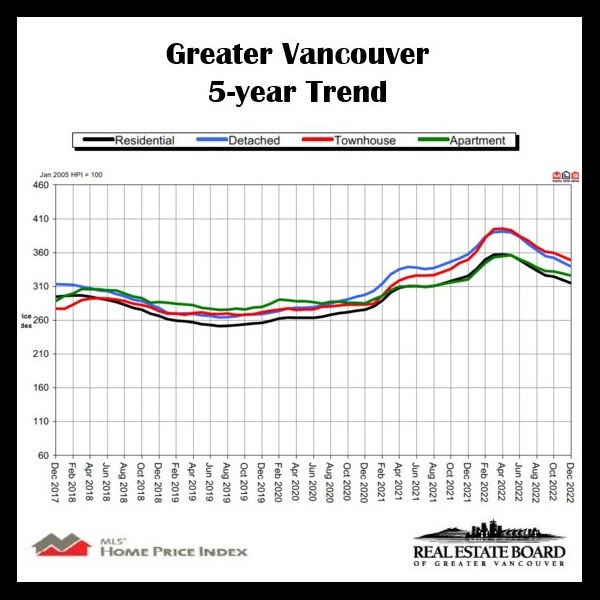

Happy New Year! Hope you had a fantastic holiday season. 2022 was an extreme year for real estate in Vancouver. It started very strong with large monthly price increases. For example, townhomes increased 5.9% in February alone. As interest rates started to increase, the price topped out in April and has been falling ever since. By the end of the year, the sales volume was typically around 30% below the 10-year average.

The strong start and the weak finish, meant the total year’s sale was only 13.4% below the 10-year average. And the number of listings were only 3.2% below the 10-year average. The MLS Home Price Index composite benchmark price for all residential properties fell 3.3% for the year.

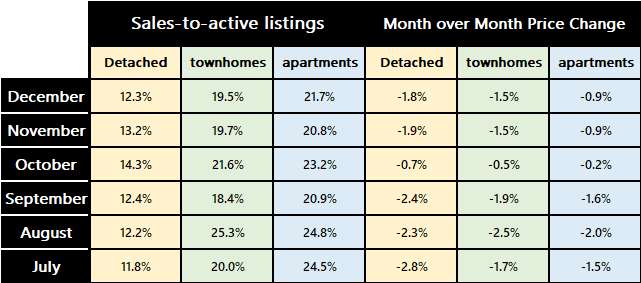

In regards to the month of December, the sales volume was 37.7% below the 10-year December average. The inventory was 38% lower than December 2021 and 60.5% lower than November 2022. I guess, the seller knows they are not going to get the price they want, so they are just waiting for better times. But even with the low inventory, the supply-demand dynamics has not improved as seen in the sales-to-active listings ratios. In early 2022, they were as high as 73% and now they are between 12.3% and 21.7%. This level of demand has resulted in continual price drops. For detached homes, prices dropped 1.8% over the month. Townhomes and apartments dropped 1.5% and 0.9% respectively.

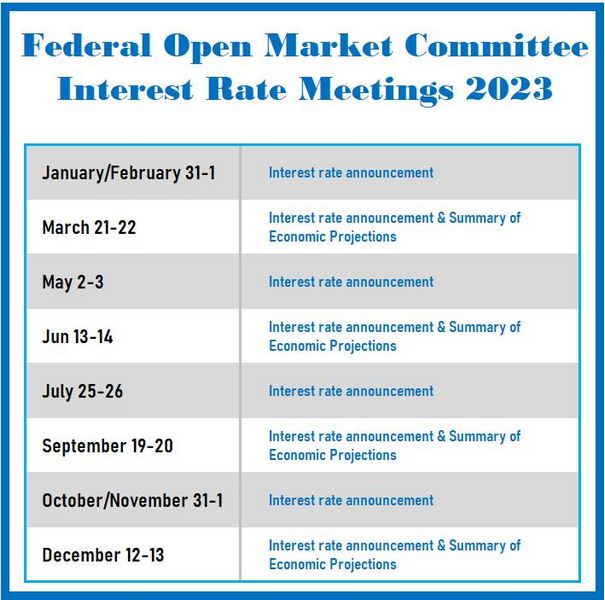

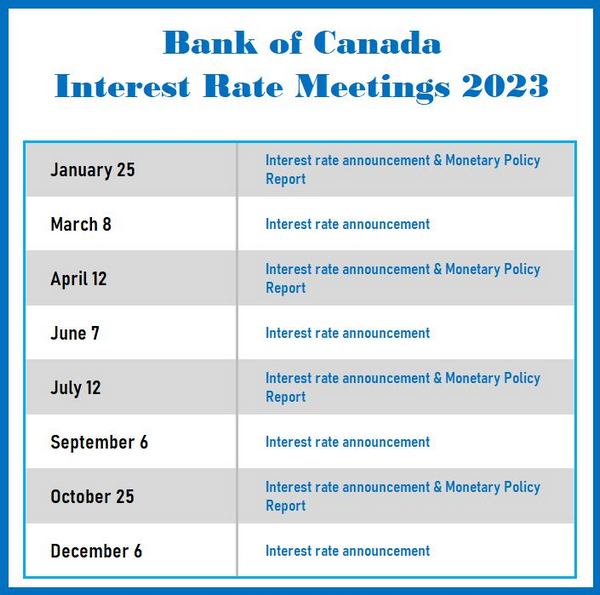

For the start of this year, the interest rate question will still loom over the market. The next meeting is on January 25th. I have included the schedule for the Bank of Canada and the Federal Reserves interest rate meetings for your convenience. Their announcements will continue to move the markets: real estate and stocks/bonds. For Canada, it is believed that there might be one or two small hikes to come. Then the government will wait to see how the economy reacts as the effect of all the rate hikes begin to show. The range of estimates for when the government will drop rates starts from about the middle of the year to beginning of next year. The bulk of the predictions are around the end of this year. If this is the case, I see a very slow spring season ahead with prices grinding downwards.

By the way, you should get your BC Assessment soon. Just note that the prices are based on estimates around July 1st of last year. As you can see on the chart above, prices have dropped since. It is not supposed to impact your property taxes because everyone’s estimate would be high, so the proportion will stay the same. Well, that’s what they said😉