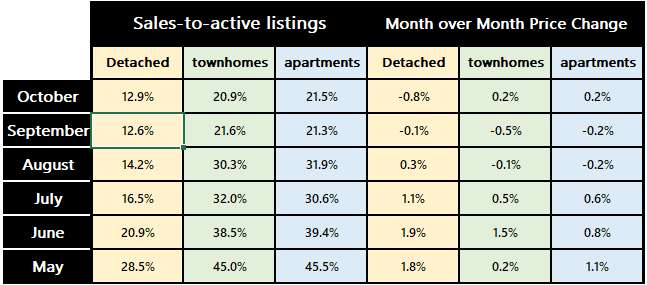

The real estate market in Vancouver, like the weather, continues to cool in October. The sales were 29.5% below the 10-year average for October. Meanwhile new listings are increasing at 5% above the 10-year average. This is slowly increasing the total number of listings in the market. It is a formula for lower prices. While the supply and demand picture look similar for the past 3 months, as measured by the sales-to-active listings ratio, for some reason townhomes and apartments eked out a month-over-month price gain in October. I don’t expect this to continue.

The Bank of Canada and the Federal Reserves both held rates unchanged in their last meetings. Most market watchers believe this is the end of the rate hikes especially in light of the latest weak employment data. And most believe that recession will hit the first or second quarter of next year. Unfortunately, that is what they said last year. But there are more signs of slowing on both sides of the border and a few of the pundits are pounding the table saying if it doesn’t happen this time, then they don’t know what they are doing. It reminds me of the tech boom and bust in the 2000s. There was a hedge fund that closed up shop close to the peak of the tech boom because they couldn’t believe the market was still going up.

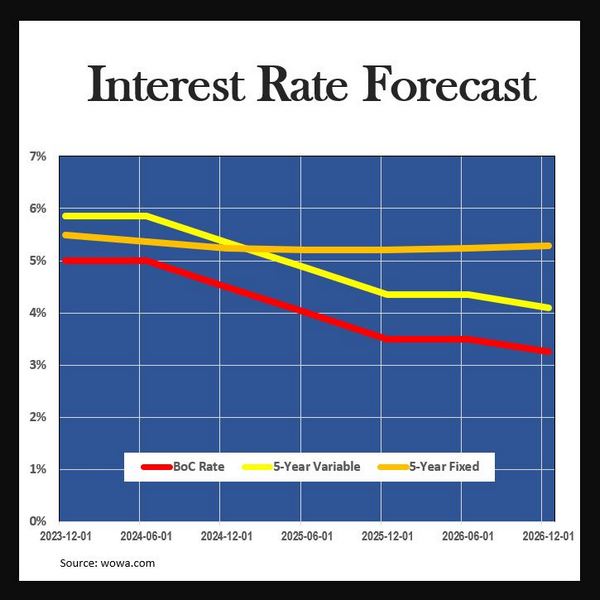

The opinion on the timing and the magnitude of the rate drops that follows the start of the recession are more varied. The market sentiment points to a better than 50/50 chance that rate will drop in May. Yet, the tricky part isn’t just predicting the short-term economic trend; it is deciphering how the market will react and how the central bankers will react to the market’s reaction. Currently, the market seems to think that once peak interest rate has been reached, then it is back to low interest rates and easy money. If the market reacts by spending and bidding things up, then the central bankers might just keep rates steady. The bottom line is that the Federal Reserves will not risk a return to inflation. So, the rate drop in mid 2024 is far from a sure thing. This doesn’t stop people from making predictions so I include the current forecast is below. Take it with a grain of salt.

I hope you are doing well. And don’t forget it is Remembrance Day this weekend. Take a moment to remember the sacrifices that allow us to have the freedoms we have today.

Have a great month!