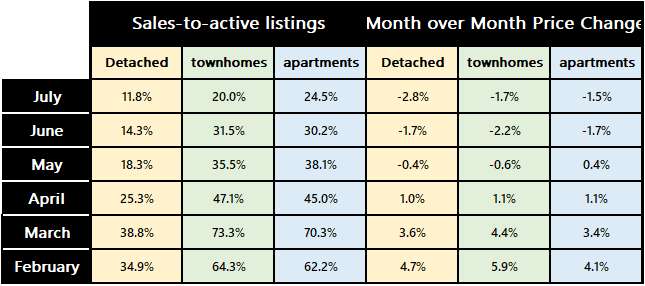

Hope everyone enjoyed their long weekend. The Metro Vancouver real estate sales activities in July were slower than June. In fact, it is at a 22 year low! Home sales plunged 43.3% from last July and were 35.2% below the 10-year July sales average. New listings have slowed but not as much as the sales. This results in a slowly growing inventory. The sales-to-active listings ratios have dropped for all classes. It is 11.8% for detached homes. 20.0% for townhomes and 24.5% for apartments. It was only in April, when these numbers were twice as large. This quick reduction of activity has resulted in month over month price drops in all categories. Detached home benchmark price dropped 2.8%. Townhomes dropped 1.7% and apartments dropped 1.5%.

Back on July 13th the Bank of Canada surprised the market by increasing the overnight rate by 1%. The largest jump since 1989. And there is more when they meet on September 7. With such a backdrop of rate increases, there were many articles predicting a drop in the price of homes in Canada. RBC sees home resales to fall nearly 23% this year, and 15% next year. Along with these declines, the national benchmark home price would fall 12% from its peak by the second quarter of 2023. Goldman Sachs also predicts a 12% price drop but over a 2-year period. BMO expects the price to drop 20% but only a mild recession. Note these numbers are for Canada and individual markets will vary greatly. The key point is that the market sentiment has gotten worse.

In June the Federal Reserve released a paper that studied the run up in house prices since the pandemic and concluded that low interest rate induced demand was the main culprit. In fact, they believe most of the variation in the price of real estate in the US from 2002 to 2021 was due to the low interest rate environment. I was impressed with the Fed’s work until I found that in 2019 two researchers in the Bank of England already came to that conclusion. Graphic included below. They suggested that almost all the real house price rises since 2000 are due to lowering interest rates engineered by the Bank of England. Also, scholars who studied the Japan real estate bubble in the 1980s also blamed low interest rates as a main cause. The Federal Reserve has 400 Ph Ds working for them. Why did it take this long to figure this out? Or did they already know? In April, I covered the story where analysis from BMO and the Union of BC Municipalities points to this fact. House prices are more determined by interest rate, then the supply. This is why as interest rates rise, demand will continue to worsen. And sales and prices will drop. Stay tuned and have a great month.